Mortgage Broker Glendale CA: Assisting You Browse the Mortgage Refine

Mortgage Broker Glendale CA: Assisting You Browse the Mortgage Refine

Blog Article

How a Home Mortgage Broker Can Help You Navigate the Intricacies of Home Financing and Funding Application Processes

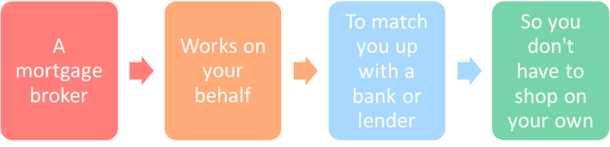

A home mortgage broker offers as an educated intermediary, equipped to streamline the application procedure and customize their technique to private financial circumstances. Understanding the complete range of exactly how a broker can assist in this journey increases essential questions concerning the subtleties of the process and the possible challenges to stay clear of.

Comprehending Mortgage Brokers

Mortgage brokers possess strong connections with numerous lending institutions, giving clients access to a broader variety of home mortgage products than they could locate on their own. This network makes it possible for brokers to bargain better terms and rates, ultimately benefiting the borrower. In addition, brokers assist customers in collecting essential documents, finishing application, and making sure conformity with the loaning demands.

Benefits of Utilizing a Broker

Using a mortgage broker provides many benefits that can considerably improve the home funding experience - Mortgage Broker Glendale CA. Among the key benefits is access to a wider series of lending products from several lending institutions. Brokers have extensive networks that allow them to present choices tailored to private economic scenarios, possibly leading to more competitive prices and terms

Additionally, home loan brokers offer vital expertise throughout the application process. Their knowledge of neighborhood market problems and offering techniques allows them to assist customers in making informed decisions. This know-how can be particularly advantageous in navigating the documents needs, guaranteeing that all required documents is finished accurately and submitted in a timely manner.

One more advantage is the possibility for time financial savings. Brokers manage much of the legwork, such as gathering details and communicating with loan providers, which permits customers to concentrate on other facets of their home-buying trip. Brokers frequently have actually established relationships with lending institutions, which can assist in smoother arrangements and quicker authorizations.

Navigating Loan Alternatives

Navigating the myriad of loan alternatives offered can be overwhelming for several property buyers. With various kinds of mortgages, such as fixed-rate, adjustable-rate, FHA, and VA loans, figuring out the finest fit for one's monetary situation needs careful consideration. Each car loan kind has unique features, advantages, and possible drawbacks that can substantially influence long-lasting price and financial stability.

A home mortgage broker plays an important duty in streamlining this procedure by offering customized advice based on private conditions. They have accessibility to a broad variety of lending institutions and can help property buyers contrast various funding products, guaranteeing they comprehend the terms, rates of interest, and payment frameworks. This professional insight can expose choices that might not be conveniently apparent to the typical consumer, such as niche programs for novice purchasers or those with unique economic scenarios.

Additionally, brokers can aid in figuring out the most suitable lending quantity and term, straightening with the buyer's budget and future goals. By leveraging their competence, buyers can make enlightened decisions, avoid common mistakes, and eventually, safe financing that aligns with their requirements, making the journey toward homeownership less challenging.

The Application Process

Recognizing the application process is crucial for potential buyers intending to protect a home mortgage. The home mortgage application process commonly begins with event needed documents, such as proof of income, tax obligation returns, and information on financial debts and assets. A home loan broker plays a critical duty in this phase, helping clients put together and organize their monetary files to offer a full picture to lenders.

Once the paperwork is prepared, the broker submits the application to multiple loan providers in behalf of the consumer. This not just streamlines the process but additionally allows the borrower to compare various car loan choices successfully (Mortgage Broker Glendale CA). The loan provider will then carry out a complete testimonial of the application, which consists of a credit scores check and an evaluation of the borrower's financial stability

This is where a home loan broker can offer invaluable assistance, guaranteeing that all demands are attended why not look here to promptly and properly. By navigating this complex procedure, a mortgage broker assists borrowers prevent possible pitfalls and attain their home financing objectives efficiently.

Lasting Financial Guidance

Among find more the essential benefits of working with a home loan broker is the provision of long-lasting economic guidance customized to individual scenarios. Unlike traditional loan providers, home mortgage brokers take a holistic technique to their clients' monetary wellness, considering not only the prompt lending demands but also future monetary objectives. This critical planning is vital for home owners who aim to preserve economic security and construct equity over time.

Home loan brokers examine numerous factors such as earnings stability, credit rating, and market trends to recommend the most appropriate financing items. They can also provide guidance on refinancing options, possible financial investment chances, and methods for financial obligation administration. By developing a long-term connection, brokers can assist clients navigate fluctuations in rates of interest and property markets, guaranteeing that they make notified decisions that align with their evolving financial demands.

Verdict

In conclusion, engaging a mortgage broker can significantly minimize the complexities associated with home financing and the car loan application process - Mortgage Broker Glendale CA. Ultimately, the support of a mortgage broker not just streamlines the prompt procedure however also offers important long-lasting financial guidance for consumers.

Home mortgage brokers have strong relationships with multiple lending institutions, offering customers access to a broader array of home mortgage items than they might find on their very own.Furthermore, mortgage brokers give vital assistance throughout the lending application procedure, helping customers recognize the subtleties of their financing selections. In general, a home loan broker serves as an experienced ally, improving the home mortgage experience and enhancing the likelihood of protecting beneficial lending terms for their customers.

Unlike conventional lenders, home mortgage brokers take an all natural method to their customers' monetary wellness, thinking about not just the immediate funding requirements yet also future economic goals.In final thought, involving a mortgage Full Article broker can significantly minimize the complexities linked with home funding and the funding application procedure.

Report this page